An investor seeking modest long-term growth with relatively low risk should consider buying into natural gas; the question is when to pull the BUY trigger. With natural gas prices near 10 year lows, high production in 2011 not fully consumed, and a warmer than normal winter, there is no surprise why natural gas is so cheap. Whether or not the price of natural gas will increase depends primarily on a strong year for industrials and the upcoming winters.

Why is natural gas so cheap?

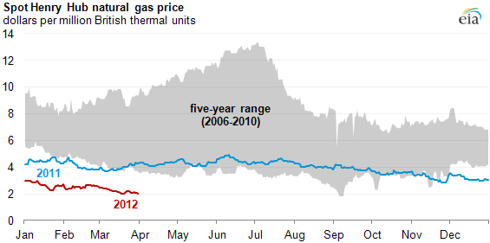

Natural gas spot prices hit the lowest average month price since April 1999. Upcoming statistics and information are found at the U.S. Energy Administration's website.

(click to enlarge images)

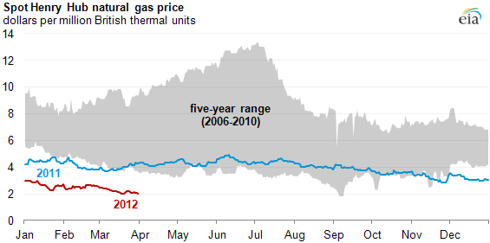

Working natural gas inventories continue to set new seasonal record highs as a very warm winter has contributed to much-lower-than-normal inventory draws. As of March 30, 2012, according to EIA's Weekly Natural Gas Storage Report, working inventories totaled 2,479 Bcf, 887 Bcf greater than last year's level and 934 Bcf above the 5-year (2007-2011) average.

Working natural gas inventories continue to set new seasonal record highs as a very warm winter has contributed to much-lower-than-normal inventory draws. As of March 30, 2012, according to EIA's Weekly Natural Gas Storage Report, working inventories totaled 2,479 Bcf, 887 Bcf greater than last year's level and 934 Bcf above the 5-year (2007-2011) average.

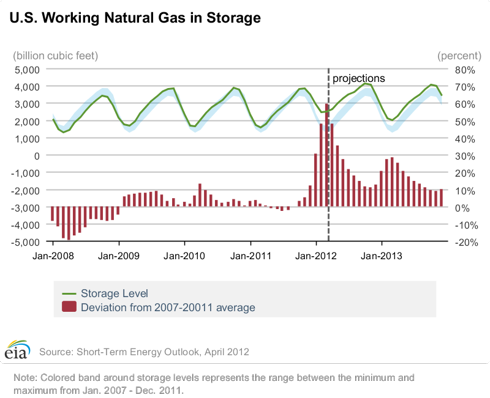

In the graph above you can see that in January 2012 working natural gas in storage exceeded 5 year averages by 60%. Production of natural gas has leveled off since January due to the drop in demand. Throughout 2012 industrials sectors (leading consumers) have increased demand in natural gas which could offset the drop in commercial and residential demand. Commercial and residential demand was expected to be low due to the "warm" winter this past season.

In 2011, the total marketed production of natural gas grew approximately 8 percent, the largest year-over-year volumetric increase in history. In times of increased production, prices fall. The chart above shows that production has leveled off, another factor indicating that the price of natural gas could begin to climb.

I believe that natural gas prices will increase modestly over time due to the current disequilibrium in the market between crude oil and natural gas prices. If you were a factory owner would you continue to use oil to power your factory or take advantage of the low natural gas prices? If a cold winter ensues heating will go up and consumer demand will increase dramatically.

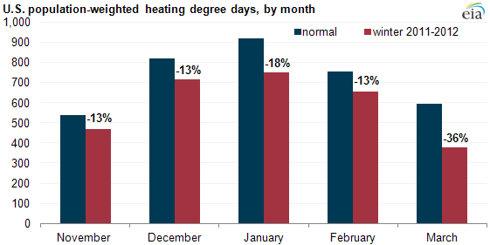

In the next graph you will see that strong growth in 2011 was not fully consumed because of the abnormally warm weather conditions during the 2011-12 Winter season.

U.S. population-weighted heating degree days were 18% below normal from November through March, reducing estimated, average residential and commercial natural gas demand by over 6 billion cubic feet per day (Bcfd) compared to the previous five-year average.

What is the future for natural gas?

According to long range expert Joe Bastardi, there is a significant chance for cold winters to come in the upcoming years (2012-13 through 2014-15, Information retrieved from AccuWeather.com). Bastardi believes that this is all part of a cyclical event which resembles the temperatures in the late '70s at the end of the last cold PDO (Pacific Decadal Oscillation).

If there is a colder winter this summer residential and commercial demand will increase. The months from August to March will be a great time to own natural gas and prices will rise due to increased demand. Keep an eye on natural gas this summer and decide if you can hold on during a short-term rugged path for potential long-term success.

Investing in any natural gas company won't guarantee results consistent with the prices of natural gas. If you choose to invest in natural gas, consider getting exposure through the futures market, ETFs, or a mutual fund. Investing in this way will give you some exposure with less risk and a stronger long-term outlook (with the exception of ETFs). Some funds to consider are FCG and AMLP.

In summary, with the lowest average month prices since April 1999 and working natural gas inventories extremely high, thoughtful investors should take advantage of the value and long-term prospect of natural gas price increases. A strong economy paired with colder winters to come should inevitably increase natural gas prices.

Please take this with a grain of salt because I do not have enough funds to personally invest and have conducted natural gas research strictly for helping intelligent investors make informed decisions.

0 comments:

Post a Comment