It's hard to imagine capitalism backfiring on public companies in this day and age, but natural gas drillers must be feeling pretty burned by the system at the moment. They answered a growing cry for domestic energy by producing natural gas in droves, only to have the market cut the value of the product to that of a cheap cell phone app.

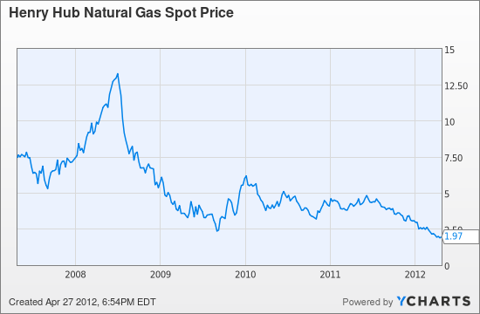

Yes, what brought in more than $6 per million BTUs just over two years ago now sells for about $1.99, as one sees from the sickening decline on the Henry Hub natural gas spot price chart. Natural gas prices are down more than 50% in the past year alone; 70% in the past six. As a result, those drillers' share prices got right royally trashed through the last couple of years.

What went wrong? Two years ago, it seemed perfectly reasonable to bet on rising natural gas demand that all the official energy organizations forecast. New technology made drilling possible in formerly inaccessible places - mainly shale fields in Pennsylvania and the Dakotas - and the nation was focused on finding clean, cheap fuel for a recovering economy. The Japanese tsunami made great demand seem even more likely because it dampened enthusiasm for competing nuclear fuel all over the world.

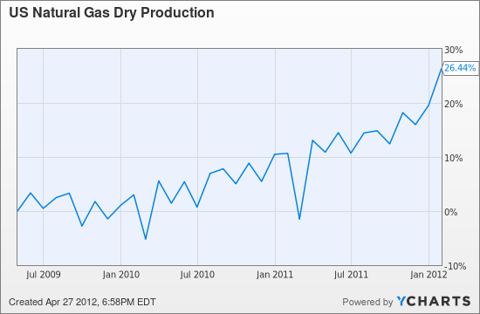

US Natural Gas Dry Production data by YCharts

But capitalism is a quite effective mechanism for determining the real demand for a product. While natural gas consumption was increasing, supply was growing faster. Although political and other outside factors have jacked with oil and gas prices in the past, this one is simply the reflection of an abundant commodity.

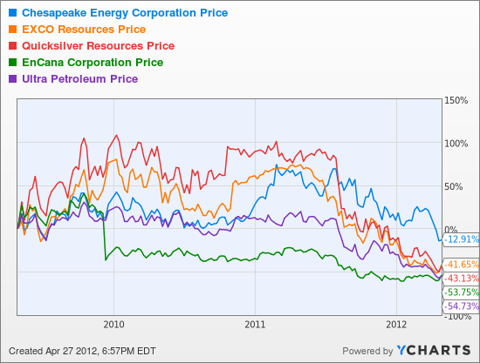

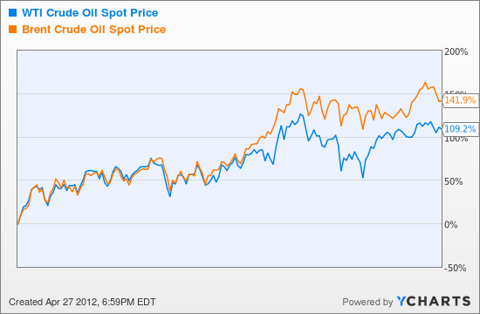

As good capitalists ourselves, we'd like to see a buying opportunity in these beaten up share prices. There are, in fact, a few reasons for optimism. Some drillers, like Canada's EnCana (ECA) have saved themselves from losses so far with smart hedges against today's gas prices. All of them are selling assets and repositioning to come up with more profitable products. Those that can move more natural gas liquids or crude oil can take advantage of more favorable price trends.

WTI Crude Oil Spot Price data by YCharts

A strong balance sheet may be the best defense for the uncertain times ahead for these companies. Of the drillers in the chart above, only EnCana and Ultra Petroleum (UPL) get strong ratings for fundamentals, and Utra's debt is beginning to pile up. EnCana is a $13 billion market cap company with substantial oil production and $3 billion in assets to sell this year. And a 4.4% dividend yield. That may be the best safety net of all for investors in this sector.

0 comments:

Post a Comment